|

If you are selling only domestically, you are reaching just a small share of potential customers. Exporting enables SMEs to diversify their portfolios and insulates them against periods of slower growth in the domestic economy. Free trade agreements have opened in numerous markets including Australia, Canada, Chile, Israel, Jordan, Mexico, and Singapore, as well as Central America. Free trade agreements create more opportunities for your businesses. UCB provides SMEs with the knowledge necessary to grow and become competitive in foreign markets. Customer can turn their export opportunities into actual sales and achieve the ultimate goal of getting paid—especially on time—for those sales.

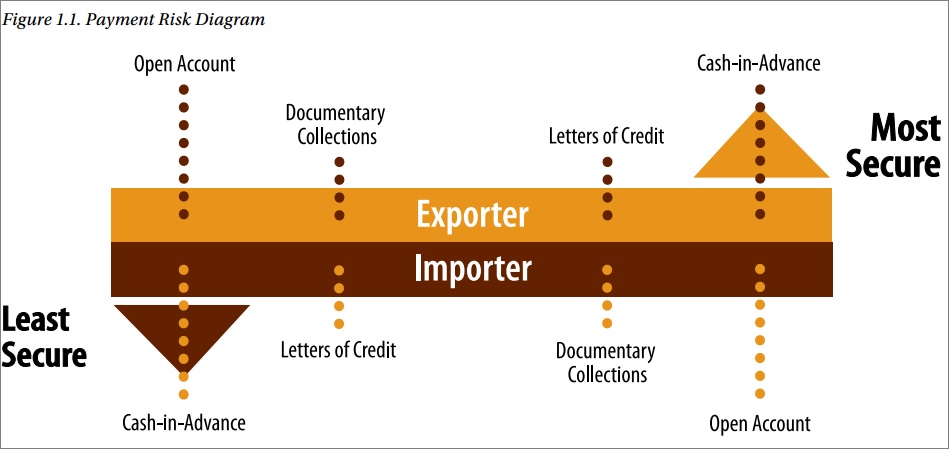

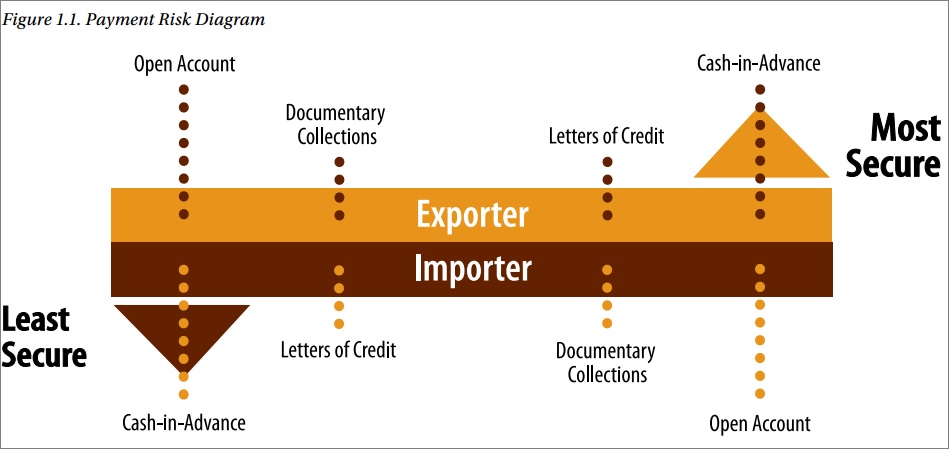

To succeed in today’s global marketplace and win sales against foreign competitors, exporters must offer their customers attractive sales terms supported by appropriate payment methods. Because getting paid in full and on time is the ultimate goal for each export sale, an appropriate payment method must be chosen carefully to minimize the payment risk while also accommodating the needs of the buyer. As shown below:

There are four primary methods of payment for international transactions. During or before contract negotiations, you should consider which method in the figure is mutually desirable for you.

Key Points:

•To succeed in today’s global marketplace and win sales against International trade presents a spectrum of risk, which causes uncertainty over the timing of payments between the exporter (seller) and importer (foreign buyer).

•For exporters, any sale is a gift until paymentis received.

•Therefore, exporters want to receive payment as soon as possible, preferably as soon as an order is placed or before the goods are sent to the importer.

•For importers, any payment is a donation until the goods are received.

•Therefore, importers want to receive the goods as soon as possible but to delay payment as long as possible, preferably until after the goods are resold to generate enough income to pay the exporter.

Letters of Credit

Letters of credit (LCs) are one of the most secure instruments available to international traders. An LC is a commitment by a bank on behalf of the buyer that payment will be made to the exporter, provided that the terms and conditions stated in the LC have been met, as verified through the presentation of all required documents. The buyer pays his or her bank to render this service. An LC is useful when reliable credit information about a foreign buyer is difficult to obtain, but the exporter is satisfied with the creditworthiness of the buyer’s foreign bank. An LC also protects the buyer because no payment obligation arises until the goods have been shipped or delivered as promised.

Documentary Collections

A documentary collection (D/C) is a transaction whereby the exporter entrusts the collection of a payment to the remitting bank (exporter’s bank), which sends documents to a collecting bank (importer’s bank), along with instructions for payment. Funds are received from the importer and remitted to the exporter through the banks involved in the collection in exchange for those documents. D/Cs involve using a draft that requires the importer to pay the face amount either at sight (document against payment) or on a specified date (document against acceptance). The draft gives instructions that specify the documents required for the transfer of title to the goods. Although banks do act as facilitators for their clients, D/Cs offer no verification process and limited recourse in the event of non-payment. Drafts are generally less expensive than LCs.

Open Account

An open account transaction is a sale where the goods are shipped and delivered before payment is due, which is usually in 30 to 90 days. Obviously, this option is the most advantageous option to the importer in terms of cash flow and cost, but it is consequently the highest risk option for an exporter. Because of intense competition in export markets, foreign buyers often press exporters for open account terms since the extension of credit by the seller to the buyer is more common abroad. Therefore, exporters who are reluctant to extend credit may lose a sale to their competitors. However, the exporter can offer competitive open account terms while substantially mitigating the risk of non-payment by using of one or more of the appropriate trade finance techniques, such as export credit insurance.

Documents Against Payment Collection

With a D/P collection, the exporter ships the goods and then gives the documents to his bank, which will forward the documents to the importer’s collecting bank, along with instructions on how to collect the money from the importer. In this arrangement, the collecting bank releases the documents to the importer only on payment for the goods. Once payment is received, the collecting bank transmits the funds to the remitting bank for payment to the exporter.

An overview of a D/P collection:

| Time of Payment | : | After shipment but before documents are released. |

| Transfer of Goods | : | After payment is made at sight. |

| Exporter Risk | : | If draft is unpaid, goods may need to be disposed or may be delivered without payment if documents do not control title. |

Documents Against Acceptance Collection

With a D/A collection, the exporter extends credit to the importer by using a time draft. The documents are released to the importer to claim the goods upon his signed acceptance of the time draft. By accepting the draft, the importer becomes legally obligated to pay at a specific date. At maturity, the collecting bank contacts the importer for payment. Upon receipt of payment, the collecting bank transmits the funds to the remitting bank for payment to the exporter. Table 4.2 shows an overview of a D/A collection:

| Time of Payment | : | On maturity of draft at a specified future date |

| Transfer of Goods | : | Before payment but upon acceptance of draft |

| Exporter Risk | : | Has no control of goods and may not get paid at due date |

How Forfaiting Works

The exporter approaches a forfaiter before finalizing a transaction’s structure. Once the forfaiter commits to the deal and sets the discount rate, the exporter can incorporate the discount into the selling price. The exporter then accepts a commitment issued by the forfaiter, signs the contract with the importer, and obtains, if required, a guarantee from the importer’s bank that provides the documents required to complete the forfaiting. The exporter delivers the goods to the importer and delivers the documents to the forfaiter who verifies them and pays for them as agreed in the commitment. Since this payment is without recourse, the exporter has no further interest in the transaction and it is the forfaiter who must collect the future payments due from the importer.

Cost of Forfaiting

The cost of forfaiting is determined by the rate of discount based on the aggregate of the LIBOR (London inter bank offered rate) rates for the tenor of the receivables and a margin reflecting the risk being sold. The degree of risk varies based on the importing country, the length of the loan, the currency of transaction, and the repayment structure—the higher the risk, the higher the margin and, therefore, the discount rate. However, forfaiting can be more cost-effective than traditional trade finance tools because of many attractive benefits it offers to the exporter.

|

GBP Exchange Rates

GBP Exchange Rates